Virginia Sales Tax Calculator

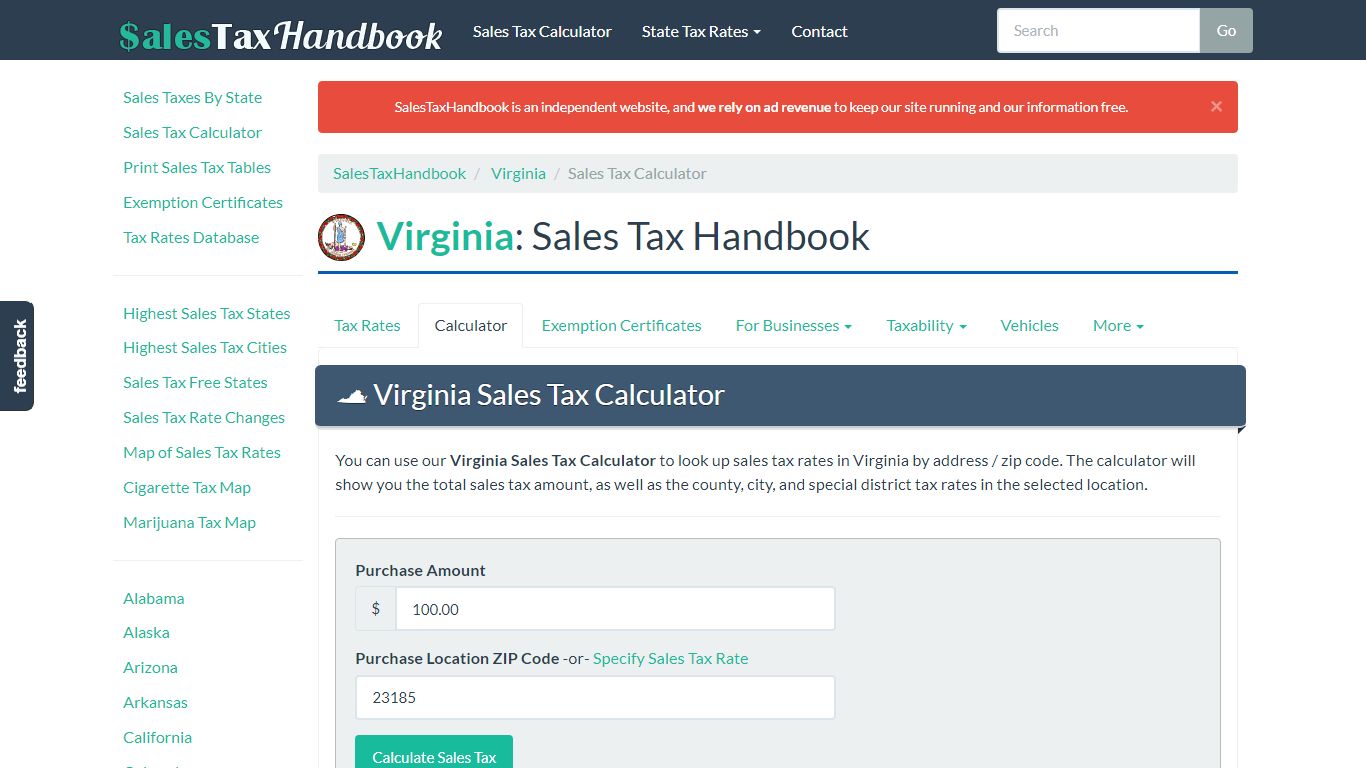

Virginia Sales Tax Calculator - SalesTaxHandbook

Virginia Sales Tax Calculator You can use our Virginia Sales Tax Calculator to look up sales tax rates in Virginia by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/virginia/calculator

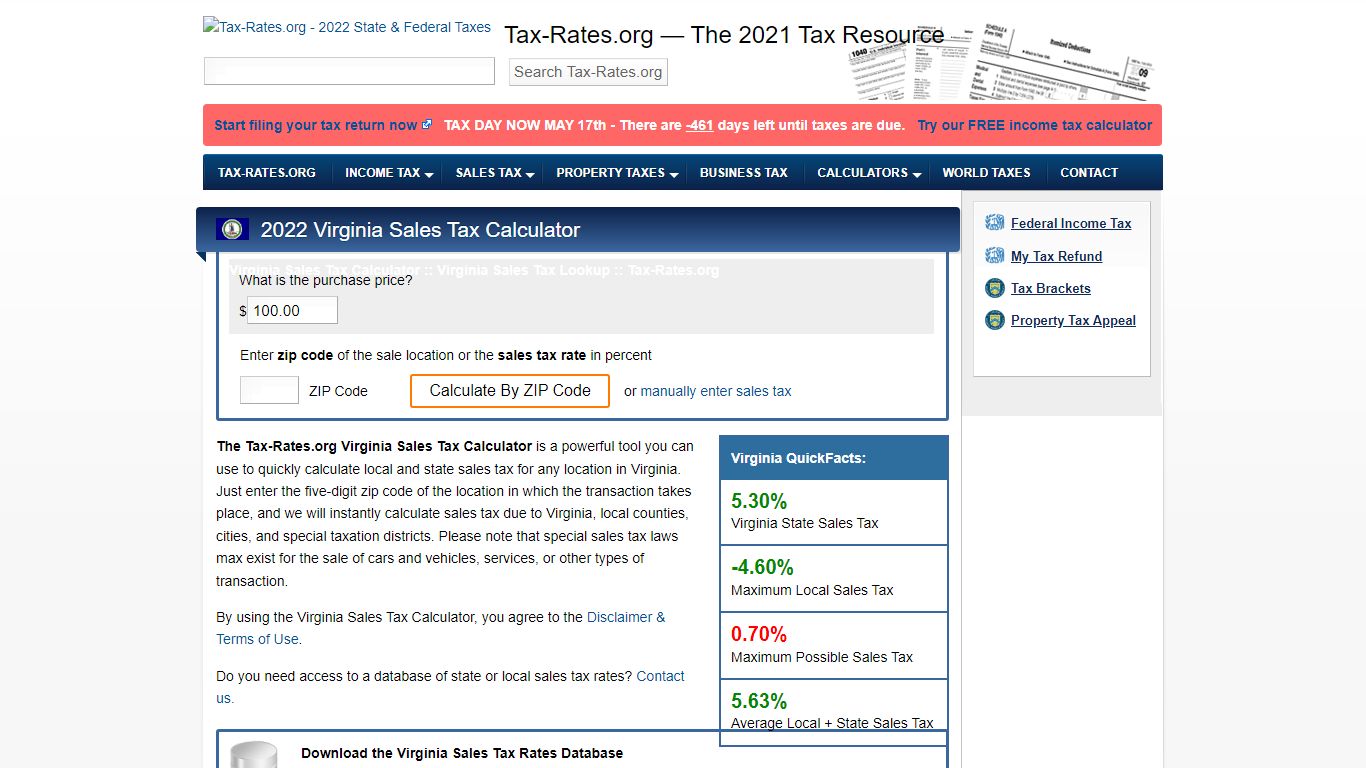

Virginia Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Virginia, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/virginia/sales-tax-calculator

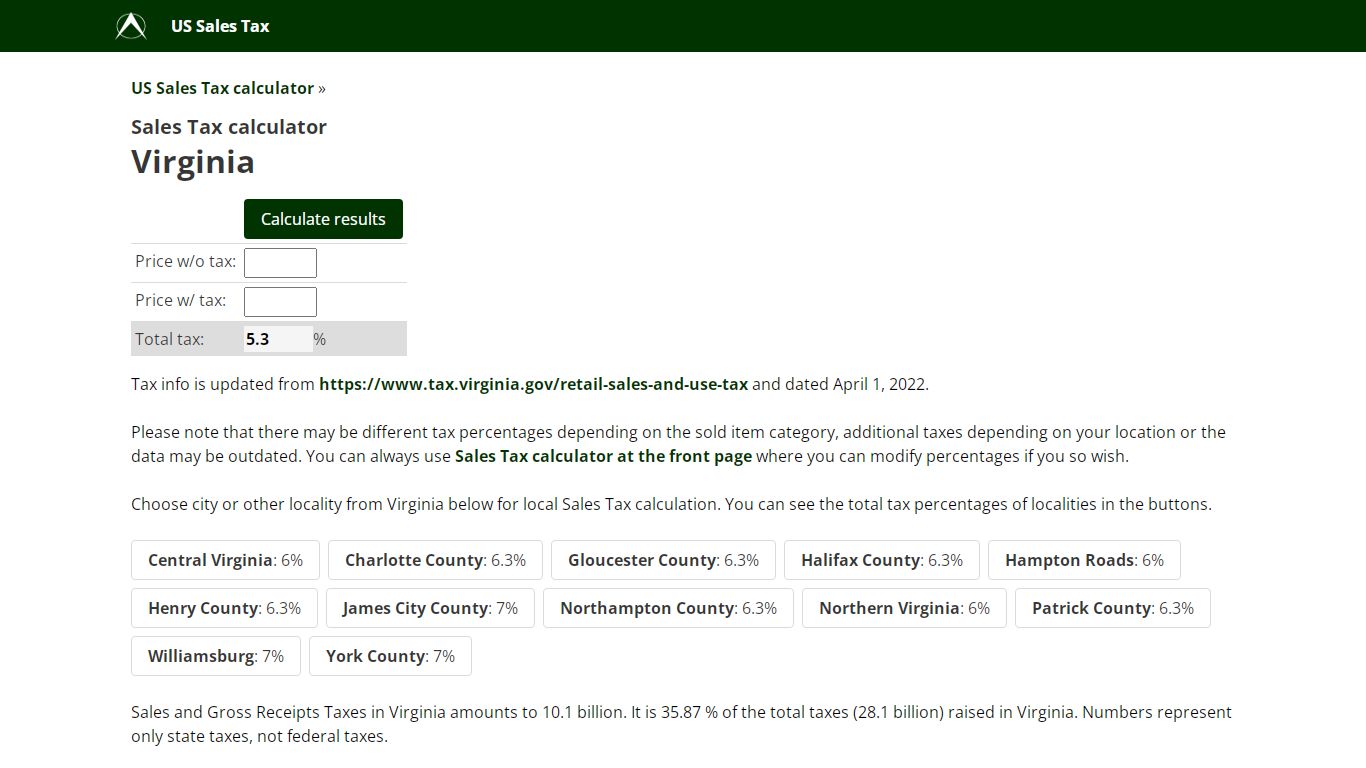

Virginia Sales Tax calculator, US

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Choose city or other locality from Virginia below for local Sales Tax calculation. You can see the total tax percentages of localities in the buttons.

https://vat-calculator.net/us-sales-tax/virginia

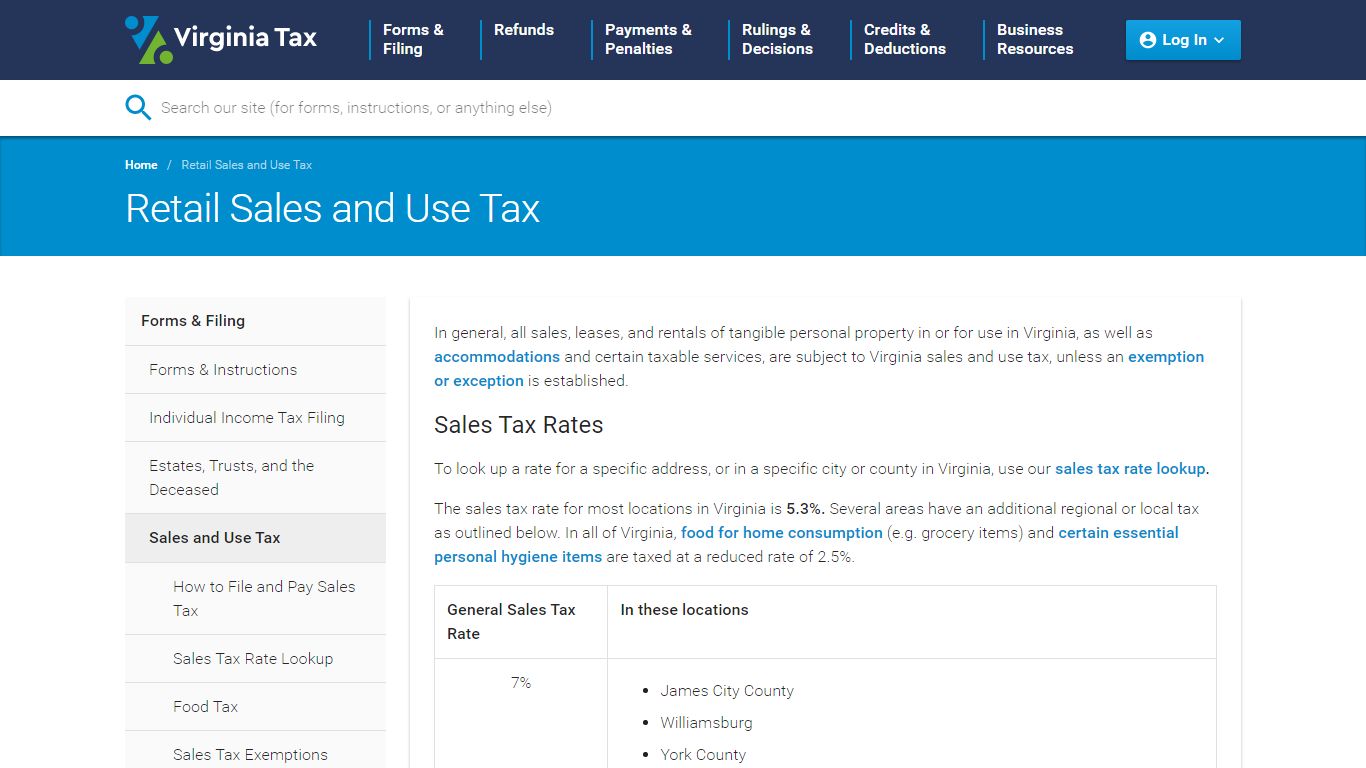

Retail Sales and Use Tax | Virginia Tax

The sales tax rate for most locations in Virginia is 5.3%. Several areas have an additional regional or local tax as outlined below. In all of Virginia, food for home consumption (e.g. grocery items) and cer tain essential personal hygiene items are taxed at a reduced rate of 2.5%.

https://www.tax.virginia.gov/retail-sales-and-use-tax

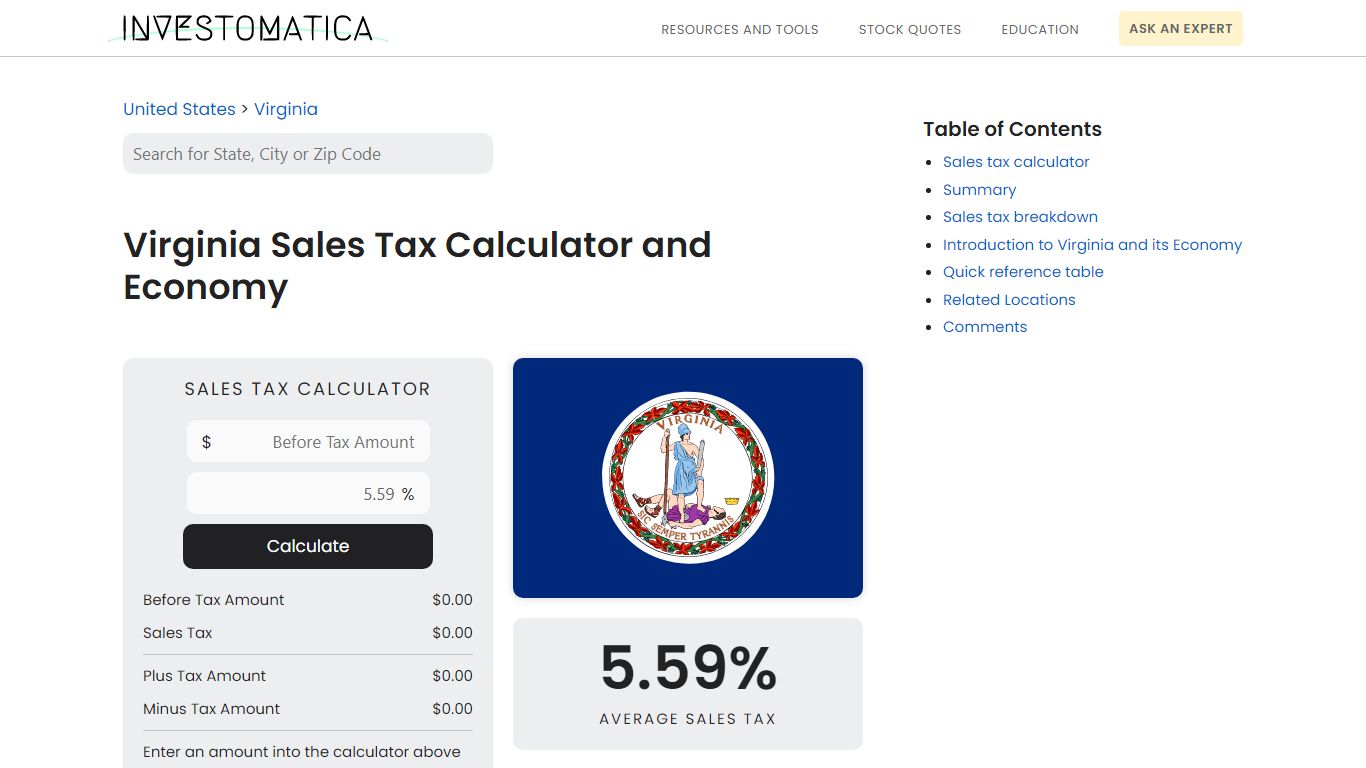

Virginia Sales Tax Calculator and Economy (2022) - Investomatica

Sales Tax Table For Virginia. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 5.59% in Virginia. All numbers are rounded in the normal fashion. To calculate the sales tax amount for all other values, use our sales tax calculator above.

https://investomatica.com/sales-tax/united-states/virginia

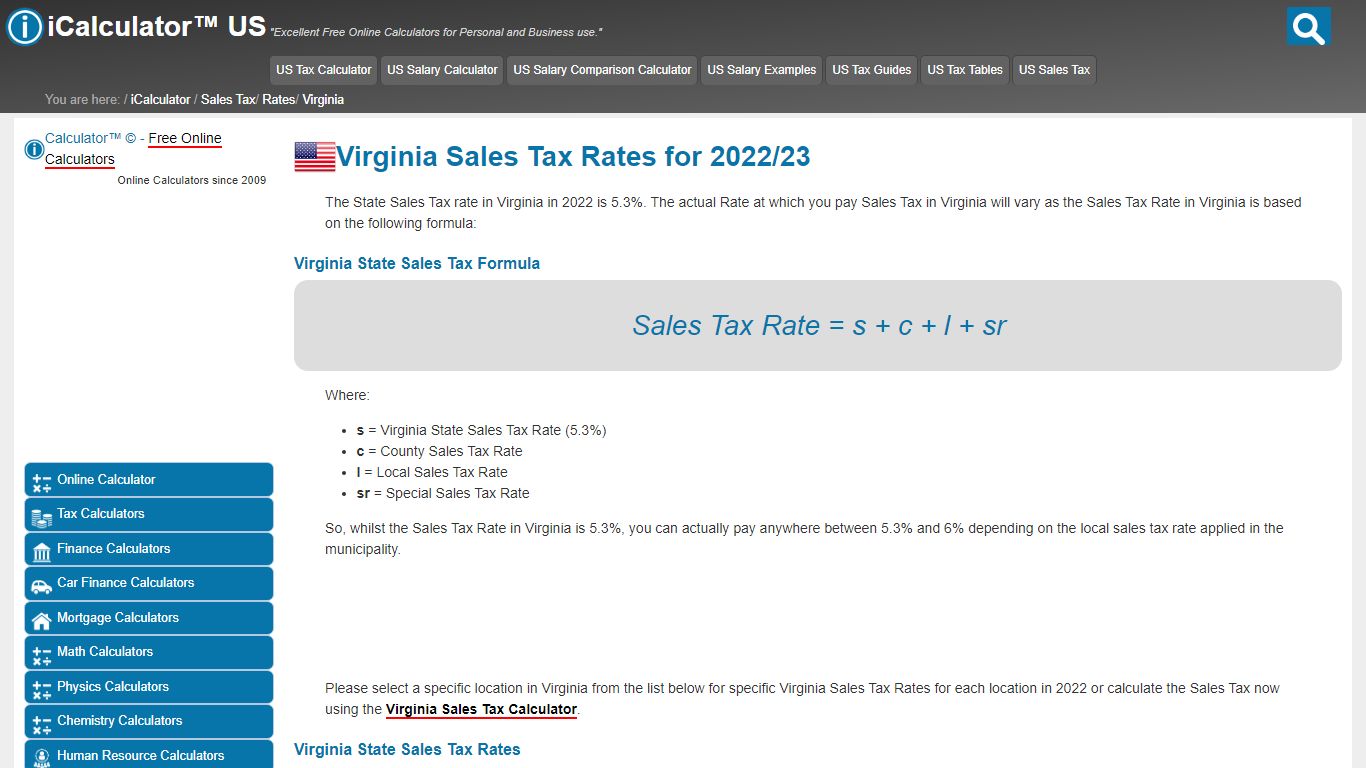

Virginia Sales Tax Rates | US iCalculator™

Sales Tax Rate = s + c + l + sr. So, whilst the Sales Tax Rate in Virginia is 5.3%, you can actually pay anywhere between 5.3% and 6% depending on the local sales tax rate applied in the municipality. Please select a specific location in Virginia from the list below for specific Virginia Sales Tax Rates for each location in 2022 or calculate ...

https://us.icalculator.info/sales-tax/rates/virginia.html

Virginia Sales Tax Guide and Calculator 2022 - TaxJar

Collect sales tax at the tax rate where your business is located. You can look up your local sales tax rate with TaxJar’s Sales Tax Calculator. Local tax rates broken down by county are also available on the Virginia Tax site. The state sales and use tax rate in Virginia is 4.3%.

https://www.taxjar.com/sales-tax/virginia

Sales Tax Rate and Locality Code Lookup | Virginia Tax

Sales Tax Rate Lookup; Food Tax; Sales Tax Exemptions; Accelerated Sales Tax Payment; Remote Sellers, Marketplace Facilitators & Economic Nexus; Retail Sales Tax on Accommodations; Motor Vehicle Rental Tax; Peer-to-Peer Vehicle Sharing Tax; Communications Taxes; Aircraft and Watercraft; Other Sales Taxes; Disposable Plastic Bag Tax; Sales Tax ...

https://www.tax.virginia.gov/sales-tax-rate-and-locality-code-lookup

Virginia Income Tax Calculator - SmartAsset

The base, statewide sales tax rate of 4.3% in Virginia is combined with a statewide local rate of 1%, meaning the effective floor for sales taxes in Virginia is 5.3%. In addition to that 5.3% rate, localities in the Northern Virginia, Central Virginia and Hampton Roads regions collect a 0.70% sales tax, bringing the total in these areas to 6%.

https://smartasset.com/taxes/virginia-tax-calculator

Arlington, Virginia Sales Tax Calculator (2022) - Investomatica

The average cumulative sales tax rate in Arlington, Virginia is 6%. This includes the rates on the state, county, city, and special levels. Arlington is located within Arlington County, Virginia.Within Arlington, there are around 26 zip codes with the most populous zip code being 22204.The sales tax rate does not vary based on zip code.

https://investomatica.com/sales-tax/united-states/virginia/arlington

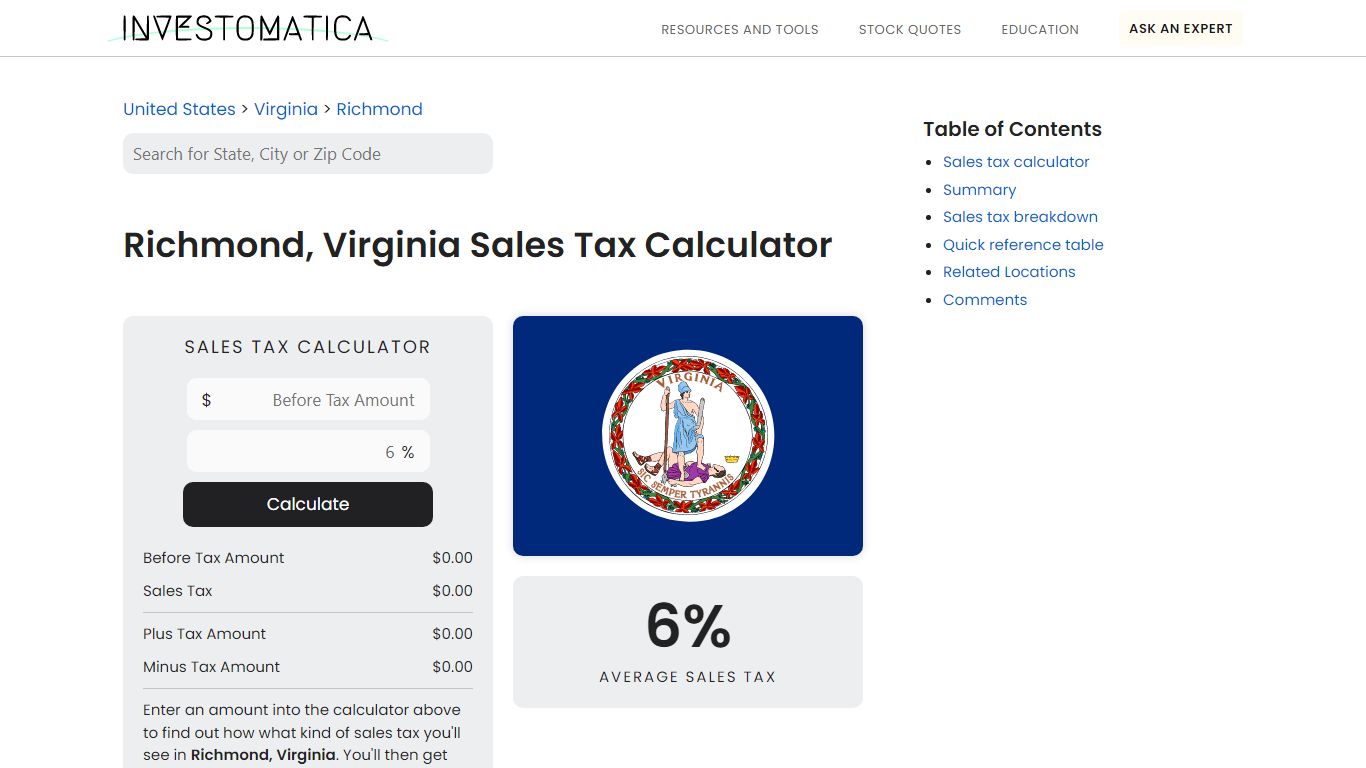

Richmond, Virginia Sales Tax Calculator (2022) - Investomatica

Sales Tax Calculator Before Tax Amount $0.00 Sales Tax $0.00 Plus Tax Amount $0.00 Minus Tax Amount $0.00 Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Richmond, Virginia. You'll then get results that can help provide you a better idea of what to expect. 6% Average Sales Tax Summary

https://investomatica.com/sales-tax/united-states/virginia/richmond